Taken from the CBA Global Markets Research report, ‘Australian residential dwelling price outlook: onwards and upwards’; first published on 15 November 2019

Overview

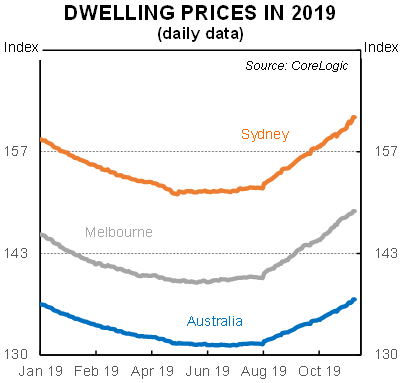

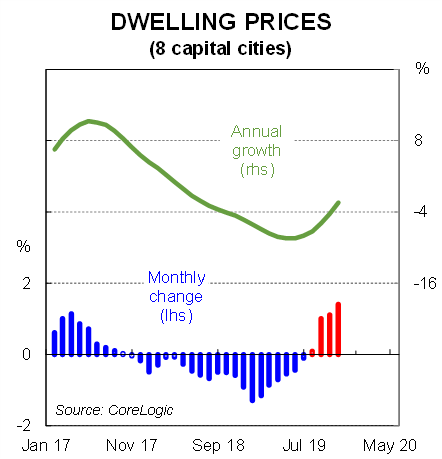

Australian capital city dwelling prices, led by Sydney and Melbourne, have risen sharply since mid-2019. Reserve Bank of Australia (RBA) rate cuts, coupled with extra borrowing capacity from the Australia Prudential Regulation Authority (APRA), induced changes to loan serviceability assessment and a surprise election outcome that removed some taxation risks around housing caused home buyer interest return in force.

History will show that the rebound in demand has been phenomenal, particularly in Sydney and Melbourne. Auction clearance rates are high, the flow of credit has picked up markedly and both house price expectations and home buyer intentions have spiked. It looks like an element of fear of missing out (FOMO) has returned to the market. As a result, the trend for prices from here need to be reassessed.

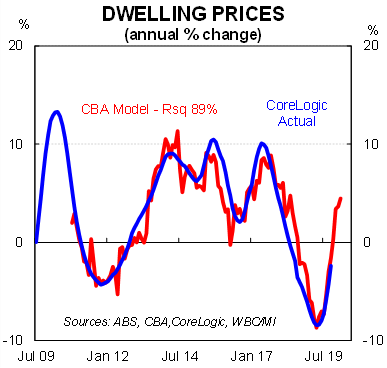

Our quantitative assessment of the residential market, overlaid with our qualitative views, means we now expect national property prices to rise by around 6% in 2020. Within the mix, however, there is likely to be significant variation in outcomes by capital city. We expect Sydney and Melbourne, underpinned by strong population growth and low unemployment, to outperform relative to the national average.

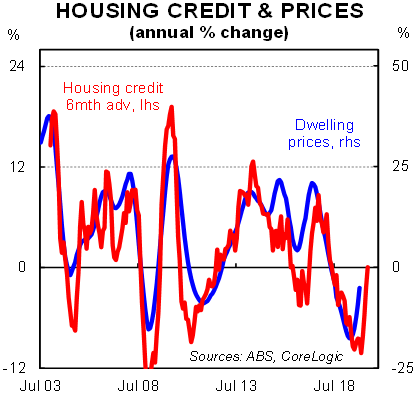

The flow of credit is key

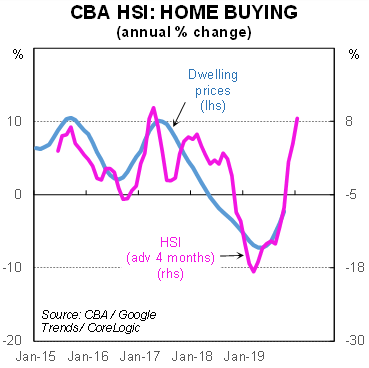

The flow of credit (i.e. new lending) has a clear impact on dwelling prices. More specifically, the annual change in the flow of credit has a close leading relationship with the annual change in dwelling prices by around six months.

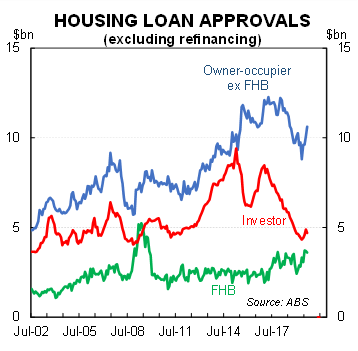

New lending is driven by the supply and demand for credit. The latest Australian Bureau of Statistics (ABS) lending data indicates that the flow of housing credit has picked up materially over the past four months and has been a broad-based increase across investors and owner-occupiers (including first home buyers).

There has been a sharp lift in the demand for credit which is being reflected in a big lift in monthly lending. This trend is set to continue based on the leading indicators of momentum. One of the single biggest factors driving the lift in demand is the RBA interest rate cuts since June which have resulted in a fall in mortgage rates to both owner-occupiers and investors.

Momentum has picked up

Like all asset markets, there is clearly momentum in the property market. It is often the case that both owner-occupiers and investors wait until they see a positive momentum in the market before they transact. This of course creates a self-fulfilling dynamic – as the market firms, would-be buyers are more confident to purchase and this brings other buyers into the market. Price rises are the inevitable outcome and this creates a positive feedback loop that can continue for an extended period, particularly in an RBA easing cycle, until there is a circuit breaker (e.g. interest rate hikes, tightening in lending conditions or other regulatory changes) or general fatigue.

And over recent months the key indicators of momentum that we monitor have all strengthened. Auction clearance rates are sitting at levels consistent with close to double-digit dwelling price growth. Both internal CBA data on home buying intentions and the house price expectations index from the WBC/MI Consumer Sentiment survey have indicated this surge.

The price outlook

Based on the leading indicators and momentum discussed above, it is likely dwelling prices will continue to rise in 2020, with Sydney and Melbourne likely to rise more than cities such as Perth and Brisbane. There are upside and downside risks and we think the balance of risks favours the upside.

Risks

Downside risks: In our view there are two key downside risks to property prices. First, the reintroduction of macro-prudential regulatory measures to slow the growth in lending. Measures introduced a few years ago to slow both the rate of growth in lending to investors and the rate of growth in interest-only lending were successful in slowing dwelling price appreciation. Second, a lift in the national unemployment rate above 5.5% would likely result in dwelling prices not lifting as much as we expect.

Upside risks: We consider there to be two key upside risks to our property forecasts. First, unconventional monetary policy that results in lower borrowing costs. We expect two further 25 basis point cuts to the cash rate in 2020 which should result in a further reduction in mortgage rates. But any move by the RBA into unconventional monetary policy such as quantitative easing that results in mortgage rates moving lower than expected would likely result in dwelling prices inflating by more than currently anticipated. Second, any further policy changes to boost housing demand such as first-home-owner grants or lower stamp duty (to domestic or foreign buyers) is an upside risk.

Disclaimer:

This document has been prepared by Arco Advisory, ABN 15089512587, AFSL 237590.

The information, opinions, and commentary contained in this document have been sourced from Global Markets Research, a division of Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. Global Markets Research has given Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) its permission to reproduce its information, opinions, and commentary contained in this document and for Colonial First State to authorise third parties to reproduce this document.

This information is taken from the CBA Global Markets Research report, ‘Australian residential dwelling price outlook: onwards and upwards’; first published on 15 November 2019.

This document has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of Colonial First State at the time of writing and may change over time. This document does not constitute an offer, invitation, investment recommendation or inducement to acquire, hold, vary, or dispose of any financial products.

Colonial First State is a wholly owned subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124, AFS Licence 234945 (the Bank). Colonial First State is the issuer of super, pension and investment products. The Bank and its subsidiaries do not guarantee the performance of Colonial First State’s products or the repayment of capital for investments.

Colonial First State has given Arco Advisory, its permission to reproduce the information, opinions, and commentary contained in this document.

This document may include general advice but does not take into account your individual objectives, financial situation or needs. You should read the relevant Product Disclosure Statement (PDS) carefully and assess whether the information is appropriate for you and consider talking to a financial adviser before making an investment decision. PDSs can be obtained from colonialfirststate.com.au or by calling us on 13 13 36.

Past performance is no indication of future performance. Stocks mentioned are for illustrative purposes only and are not recommendations to you to buy sell or hold these stocks.

This document cannot be used or copied in whole or part without Colonial First State’s express written consent. Copyright © Commonwealth Bank of Australia 2020.