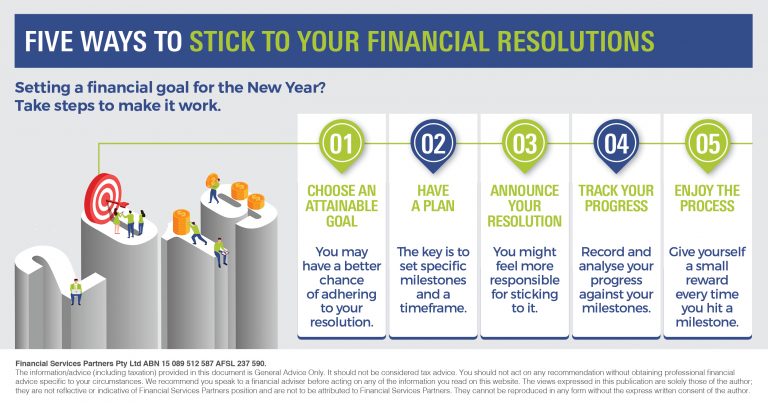

Five ways to stick to your financial resolutions

Setting a financial goal for the New Year? Take steps to make it work. It’s that time of year when we set new goals or dust off old ones. But how can we boost our chances of sticking to our financial resolution? Here are some practical tips.

It’s that time of year when we set new goals or dust off old ones. But how can we boost our chances of sticking to our financial resolution? Here are some practical tips.

1. Choose an attainable goal

It’s good to be ambitious, but you may have a better chance of adhering to your resolution if you have a smaller, reachable goal. Using the well-established SMART formula can help. SMART stands for:- Specific – make your financial goal as clear as possible.

- Measurable – if your goal is specific, most likely it is measurable too.

- Achievable – choose a goal that you can reach in the foreseeable future.

- Relevant – ensure you really want this goal and that it would benefit you.

- Time bound – set a timeline for achieving your target.

2. Have a plan

Create a plan that can help you take small but regular steps toward reaching your financial goal. The key is to set specific milestones and a timeframe for each. You may wish to talk to your financial adviser about setting a plan for your financial situation and goal.3. Announce your resolution

Tell your family members or friends about your resolution, or post it on social media. By making your resolution known to others, you might feel more responsible for sticking to it.4. Track your progress

Record and analyse your progress against your milestones. It could help to get your financial adviser to check your progress every so often.5. Enjoy the process

Enjoying the process of reaching your goal may help you stick to your financial resolution. So give yourself a small reward every time you hit a milestone. Whether you want to boost your savings or retirement fund, your financial adviser may be able to help you stay on track to achieve your resolution.Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Financial Services Partners position and are not to be attributed to Financial Services Partners. They cannot be reproduced in any form without

the express written consent of the author.

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. Financial Services Partners Pty Ltd ABN 15 089 512 587, AFSL 237590