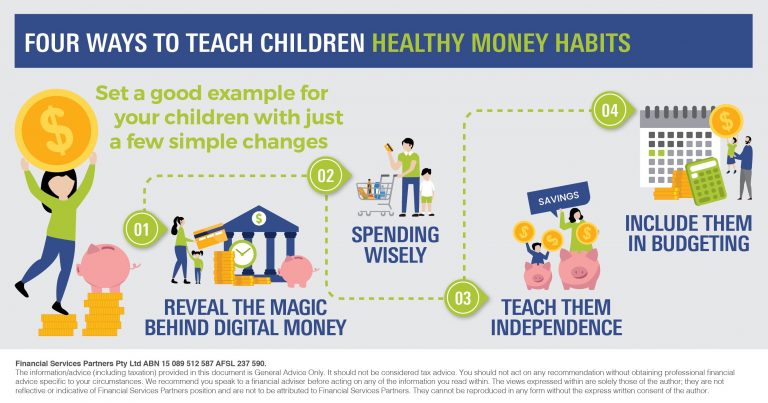

Here are four common ways you could teach your children healthy money habits.

1. Revealing the magic behind digital money

Your children have likely seen you pay for hundreds of transactions without glimpsing cash changing hands. For small children, it can seem like money problems are solved with magic – just wave or tap a plastic card. This makes it important to discuss the value of money with them. A good way to start is to explain how your earnings get deposited into your bank account and how you use this account to pay bills. For older children, consider showing them how taxes are deducted from your salary.

2. Spending wisely

Frequently buying things on an impulse could send the message that it’s fine to spend without planning. Sticking to a budget is key to avoiding impulse-buying. To set an effective budget, consider working with a professional financial adviser. Your adviser may help develop a budget that factors in your income, expenses and financial obligations.

3. Teaching them independence

It’s convenient to do everything for your children. But by giving them a chance to have their own money and decide how and where to spend it, they could learn powerful lessons about budgeting. For adult children, always offering them financial help can create a cycle of dependency. Letting them make their own money decisions could help them develop financial responsibility.

4. Including them in budgeting

Many parents keep household financial planning and budgeting to themselves. While you don’t have to fully involve your children in managing your family’s finances, giving them a role to play, such as getting them to do grocery shopping using a set budget, can teach them lessons about money. If your children are old enough to earn some income, why not get them to pitch in to help achieve a family goal?

Using your influence positively

You can strongly influence your children in relation to money, so it’s important to pass on smart money management skills. If you don’t know where to start, consider reaching out to your financial adviser to help you stay on top of your finances through proper planning and budgeting.

DISCLAIMER

Financial Services Partners Pty Ltd

www.financialservicespartners.com.au

ABN 15 089 512 587 AFSL 237 590. The information/advice (including taxation) on this website is General Advice Only. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. You should obtain a Product Disclosure Statement relating to the products mentioned, and consider the statements before making any decision about whether to acquire products or services.

We take your privacy seriously and as such we, or any of the Financial Services Partners financial advisers, will never ask you to transfer money via email request unless we have spoken to you in person or the transfer is part of an existing arrangement between you and your financial adviser. If you receive any such requests that are outside the agreed arrangements you have with your financial adviser, please contact our office immediately to confirm the validity the request before you take any action – .