Why did these events affect share prices?

Coronavirus

There have been more new cases being reported outside of China. This includes developed countries such as the US, Europe and Australia. To stop the virus spreading some governments have implemented severe bans on travel. For example:

- In Italy, the government has shut down travel within the country until early April because of how many cases they are seeing;

- Australia has imposed 14-day self-isolation limits on all new arrivals into the country.

Restricting travel means people make less contact with each other. This gives less opportunities for the virus to spread and hopefully reduces the total number of people infected. However, it also hurts businesses because it makes it harder for people to buy or use their goods or services. This is not only bad for businesses but also their employees. In this case, we are talking about a weaker economy which will see lower profits and dividends for companies. The fear of this has contributed to investors selling out of shares in recent times.

Governments have been trying to help support growth. An example in Australia includes lowering deeming rates by 0.5% so retirees can access more of the Age Pension as well as a one-off $750 payment. This helps give people income to handle weaker incomes from less hours, for example, with businesses also getting support to encourage them to keep their staff. You are likely to see more efforts here given reports that the Morrison Government is considering a second stimulus package.

Oil deal collapse

Oil prices are based on a mix of how much has been produced vs how much is needed for cars, industry, energy etc. Last week there was a potential deal that would have seen global production cut to support oil prices and help countries dependent on high oil prices to fund government spending. However, Russia did not agree to this deal for several reasons.

In response, Saudi Arabia increased its supply of oil and cut prices. Saudi Arabia is a large oil producer and by doing this oil prices fell over 27% last week. This hurts oil producing countries that need higher prices and also hurts Australian producers like Woodside or refiners like Caltex. Since the world economy is weaker because of Coronavirus, another hit to it from this shock gave investors additional reasons to sell their shares.

Staying the course

Your portfolio is set up with risks like share prices falling in mind. We set it up with other investments like cash or bonds to help reduce the impact of this risk on your wealth. This is at the core of diversification and we have considered how your portfolio will function depending on the market environment. In periods like we have seen in the last week, your investments in cash and bonds will have continued to hold their value or even increased as share prices fell.

Importantly, your portfolio is expected to deliver, even after this week, a long-term return that will meet financial objectives. You will have worked with your Financial Adviser to understand how much risk you can take with your investments. That work will continue to hold you in good stead through difficult times like this.

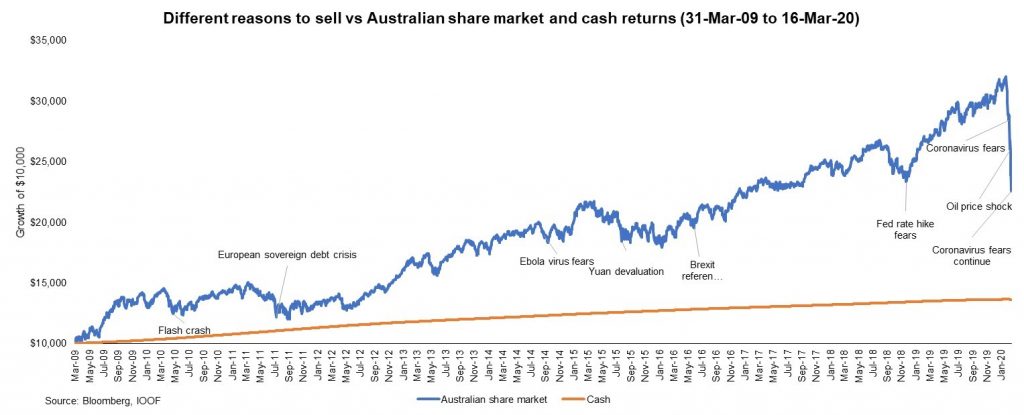

There are often reasons to sell out of shares. The chart below shows a few different reasons over the last 11 years such as the Ebola outbreak or Brexit. The important message to hold onto is that over time the market has recovered and allows you to earn strong long-term returns. Since the Global Financial Crisis, even after the start to this year, investors have more than doubled their money. If you panicked and went to cash however, assuming a starting point of $10,000, you would have only earned $3,628 over the last 11 years versus a potential $12,569 in Australian shares (as of 16 March).

Speak with your adviser

If you have any further questions, please reach out to your Financial Adviser. Over the long term, being invested is crucial. Cash is not a viable long-run alternative with the cash rate at 0.5% and an RBA cut to 0.25% expected. By contrast, we expect a diversified portfolio to continue being the answer to achieving your objectives.

Prepared by – Cameron Curko

Approved By – Matt Olsen

Important Information

This report is prepared by the IOOF Research team for:

Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837, Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323, Elders Financial Planning ABN 48 007 997 186 AFSL 224645, Financial Services Partners ABN 15 089 512 587 AFSL 237 590, Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL 244252, RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429, Shadforth Financial Group Ltd ABN 27 127 508 472 AFSL 318613 (‘Advice Licensees’).

This report is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of the Advice Licensees.

Declaration of interests: The Advice Licensees and/or its associated entities, directors and/or its employees may have a material interest in, and may earn brokerage or other fees from, any securities or other financial products referred to in this report, or may provide services to, do business with or seek to do business with the company referred to in this report. The Advice Licensees and associated persons (including persons from whom information in this report is sourced) may do business or seek to do business with companies covered in its research reports. As a result, investors should be aware that The Advice Licensees or its associates may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as a single factor in making an investment decision. A list of material interests of The Advice Licensees and its associates, and product issuers referred to in our research reports, can be found on the following IOOF website link http://www.ioof.com.au/adviser/investment_funds/ioof_advice_research_process

The information contained in this report is for the use of advisers of AFSL entities authorised by The Advice Licensees in writing.

General Advice Disclaimer: The information in this report is general advice only and does not take into account the financial circumstances, needs and objectives of any particular investor. Before acting on the general advice contained in this report, an investor should assess their own circumstances or seek advice from a financial adviser. Where applicable, the investor should obtain and consider a copy of the prospectus or other disclosure material relevant to the financial product before making any investment decision to acquire a financial product. It is important to note that the price or value of financial products go up and down and past performance is not an indicator of future performance.

Analyst Certification: This report has been prepared and issued by the IOOF Managed Funds Research team members, who certifies that: (1) all of the views expressed in this report accurately reflect his or her personal and professional views about any and all of the subject securities or issuers; and (2) no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed herein.

The writers, and/or entities in which I have a pecuniary interest, None.

The Advice Licensees believe that the information contained in this report has been obtained from sources that are accurate but has not checked or verified this information. To the extent permitted by the law, The Advice Licensees, its related bodies corporate, its directors, officers, employees, authorized representatives and agents accept no liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of the information contained in this report, or in relation to, the contents of or omissions in this report.

This report is current as at the time of publication but may be superseded by future publications. You should confirm the currency of this report and obtain summary information about: material interests and Research analysts’ holdings; the qualifications and experience of the IOOF research team; and the coverage, criteria, methodology and spread of ratings from http://www.ioof.com.au/adviser/investment_funds/ioof_advice_research_process

If an investor requires access to other research reports they should ask their adviser who can obtain these from their dealer group intranet.