The increasing cost of goods and services – from food and housing to transport and utilities – is a reality most Australians have to face every day.

Data from the Australian Bureau of Statistics (ABS) shows that living expenses for employee households were up by 2 per cent in September 2018 compared to a year ago. Among self‑funded retiree households and age pension recipients, living costs rose by 2.3 per cent and 2.2 per cent respectively.[1]

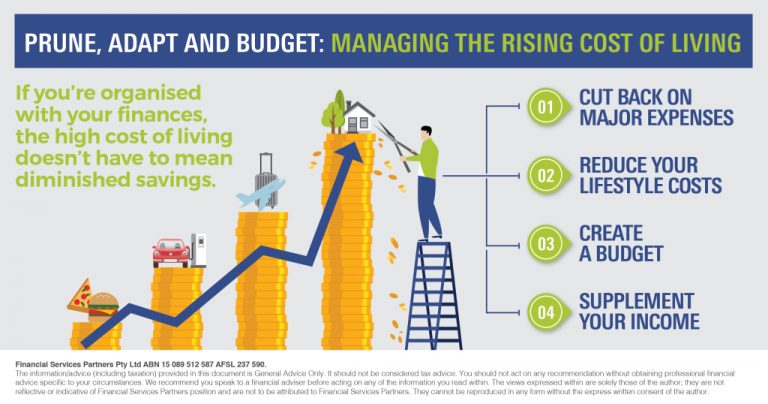

But don’t panic. By being organised and smart about your finances, you could manage rising costs without draining your savings and sacrificing your financial security.

Cut back on major expenses

Reducing your expenses is an obvious way to manage the high cost of living. But rather than taking a piecemeal approach, it may be more effective to cut back on the largest drains on your funds.

For a start, you may want to trim costs in areas that, according to the ABS, account for more than half of Australian households’ weekly expenditure: housing, food and drinks, and transport.[2] Do you really need a second car? Can you negotiate a lower mortgage rate with your lender? Paring discretionary expenses in these areas may result in big savings.

Reduce your lifestyle costs

It may be worth auditing your lifestyle expenses to see if you could do some pruning. These costs can burn a big hole in your pocket if you don’t monitor or check them. Research shows that Australians spent $145 billion on lifestyle goods and services in 2017.[3]

While you don’t have to give up all the things you enjoy, cutting down on, for example, your overseas holidays or dining out could go a long way towards reducing your costs. Savings in these areas may help you cover essential expenses or boost your nest egg and investments.

Create a budget

Having a budget and sticking to it may help you minimise unnecessary expenses. A budget tracks your weekly or monthly spending and may help ensure you have enough money to cover essentials while being flexible enough to manage unexpected or increased costs.

To create a budget that factors in your income, expenses and financial obligations, it is recommended that you consult a professional financial adviser. Your adviser may also suggest ways to manage your costs and build up your savings.

Supplement your income

Increasing your income could be another way to ride out the rising cost of living. You could do this by taking on extra work in your spare time or starting a side business. And in today’s digital sharing economy, earning extra money in a way that suits you has never been easier. Become a private tutor in your field of expertise. If you’re an avid gardener, advertise your gardening services online and in your community. Rent out your car or a spare room in your house, join the drive-share economy or even pet sit. By having one or two side gigs, you won’t have to dip into your savings just to meet the rising cost of living.

If you have enough savings on top of your emergency fund, you may want to consider investing to grow your capital. Your financial adviser could recommend strategies to help you generate an income from your investments.

The high costs of goods and services may affect your savings and lead to money-related stress. But if you’re smart about your finances, you could keep your cost of living in check and remain financially secure.

Download PDF Articlehub_Prune, adapt and budget

Download White Label Version Articlehub_Prune, adapt and budget

Notes

[1] Australian Bureau of Statistics, September 2018, ‘Selected Living Cost Indexes, Australia’. Accessible at: http://www.abs.gov.au/ausstats/abs@.nsf/PrimaryMainFeatures/6467.0?OpenDocument.

[2] Australian Bureau of Statistics, September 2017, ‘Household Expenditure Survey, Australia: Summary of Results, 2015–16. Accessible at: http://www.abs.gov.au/ausstats/abs@.nsf/Latestproducts/6530.0Main%20Features32015-16.

[3] Mozo, August 2017, ‘Australians eating away savings, spending a whopping $4 billion on food and drink per month’. Accessible at: https://stat.mozo.com.au/images/more-on-mozo/media-releases/MOZO-MEDIA-RELEASE-cost-of-lifestyle-2017-final.pdf.

DISCLAIMER

Financial Services Partners Pty Ltd

www.financialservicespartners.com.au

ABN 15 089 512 587 AFSL 237 590. The information/advice (including taxation) on this website is General Advice Only. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. You should obtain a Product Disclosure Statement relating to the products mentioned, and consider the statements before making any decision about whether to acquire products or services.

We take your privacy seriously and as such we, or any of the Financial Services Partners financial advisers, will never ask you to transfer money via email request unless we have spoken to you in person or the transfer is part of an existing arrangement between you and your financial adviser. If you receive any such requests that are outside the agreed arrangements you have with your financial adviser, please contact our office immediately to confirm the validity the request before you take any action – .