By Bob Cunneen, Senior Economist and Portfolio Specialist

The ‘painful squeeze’ from high inflation and rising interest rates

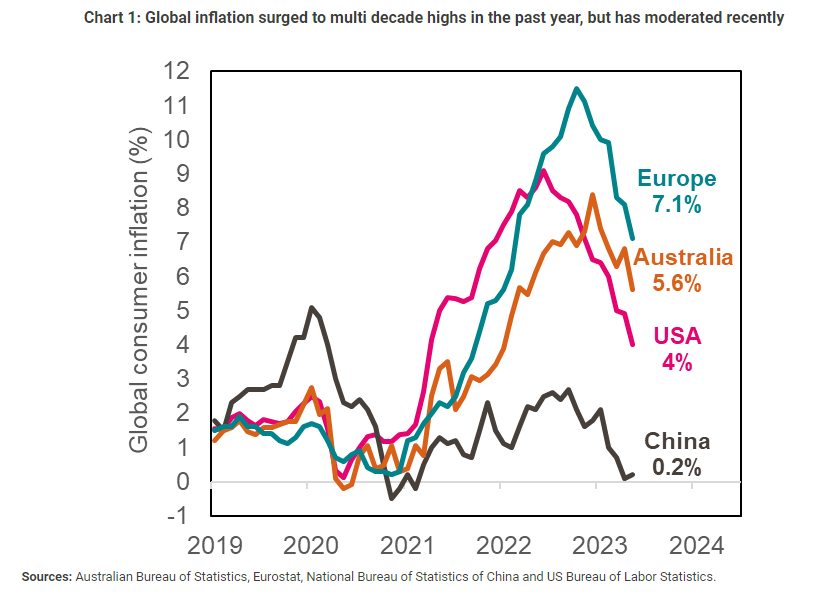

Global inflation surged to multi decade highs in the past year (Chart 1). The mix of stronger demand, supply disruptions and the Ukraine conflict generated a tremendous rise in commodity and consumer prices. Inflation surged to above 10% in Europe, above 9% in the US and to 8.4% in Australia in late 2022. This led to a “painful squeeze” for consumers who are struggling to heat their houses and keep food on the table. Australian electricity prices increased by 14% and food by more than 11%. Fortunately, there has been some moderation recently in price pressures with Australia’s inflation coming in at 5.6% in May and the US at 4%.

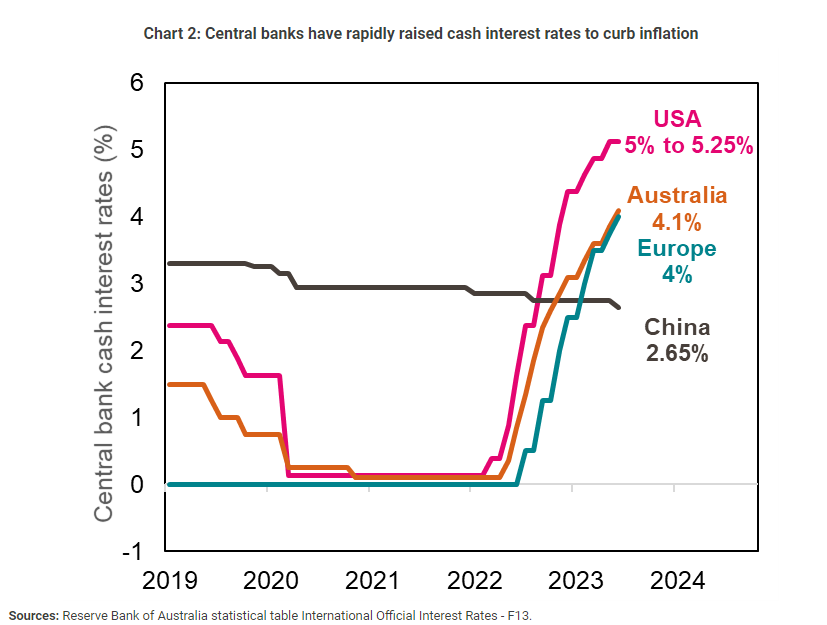

This painful squeeze has been very intense for borrowers and renters. Central banks rapidly raised cash interest rates to curb inflation (Chart 2). For the US, cash interest rates increased by 3.5% in the past year to currently stand above 5%. The European and British central banks also followed this harsh medicine by pushing cash interest rates to respectively 4% and 5%. Our central bank in the Reserve Bank of Australia (RBA) is also following this script with the cash interest rate climbing from 1.35% in July 2022 to 4.1% presently. This has seen mortgage borrowing rates surge higher. For renters, there has also been an acute squeeze as landlords have responded to higher borrowing costs by putting up rents for tenants. In Australia’s case, rents increased by 11.5% in the past year to June according to CoreLogic.

There were some major financial and political shocks to contend with during the financial year. Russia’s devastating invasion of Ukraine in February 2022 is a shockwave that is still rippling across the world. Concerns over energy and food supply were a persistent feature during the past year. Fortunately, Ukraine’s brave defence has stalled the Russian army and remarkably led to political turmoil in Russia in June 2023.

There was also a global banking tremor in March 2023 with the collapse of three US regional banks and the takeover of Switzerland’s second largest bank in Credit Suisse. This has seen both European and North American banks applying harsher credit standards to businesses and consumers, thereby casting a shadow over the global economy.

The global economy is in a sharp slowdown with a recession possibly looming

Global economic activity has provided both positive and negative surprises. The negative surprises have been a sharp slowdown in economic activity. Some economies like Germany and New Zealand have even fallen into recession as consumers have cut spending given rising energy and food costs as well as higher interest rates. This global growth slowdown has led to consumer inflation pressures starting to moderate.

The US economy was more resilient with strong jobs growth. The US unemployment rate ended the year at a very low 3.7% given the persistent shortage of American workers. Wages growth accelerated to an above 5% annual pace with workers having more bargaining power. However, these higher wages still barely compensate for high inflation. There are also warning signs of a potential recession given that US consumer spending and housing construction is under strain with the squeeze from inflation and interest rates.

China’s sharp economic slowdown and the financial woes of their property developers captured the headlines. China’s economy was also severely constrained by the government’s ‘Zero-COVID’ strategy of lockdowns until late 2022. This had also materially contributed to problems in global supply chains with extensive delays in obtaining goods from China’s factories and shipping ports. There was some mild improvement in China’s economic activity in 2023 with a rebound in industrial production and retail sales. However, China’s growth prospects are restrained given that the national government’s intense scrutiny of property and technology companies is constraining investment.

Australia’s economy is struggling

Australia began the financial year with promise. Low interest rates and resilient businesses and consumers had seen the Australian economy make a rapid recovery after the initial tragic wave of the pandemic. Notably the robust jobs growth allowed the unemployment rate to fall to 3.5%, which is near a 50 year low.

However, Australia is also confronting the global challenge of high inflation and rising interest rates. Australia’s consumer inflation was running at 5.6% in the year to May 2023. Leading this inflation surge has been the daily food essentials such as dairy (15% annual rise) and bread (12.8%) as well electricity (14%). If you wish to take a holiday from these pressures, there was no cheap place to relax with travel costs also having risen 7.3%.

High inflation causes a dramatic decline in purchasing power. The typical response for consumers being squeezed by higher prices is to move to buy cheaper items or to cut spending. This is now occurring with the retail sector essentially in recession. In the past year to May, retail spending adjusted for inflation has fallen.

Yet the RBA has continued to rapidly raise the cash interest rate. The RBA’s view is that inflation remains “too high” and that high interest rates are needed to ensure that inflation falls back to the 2% to 3% target range. The RBA also considers that Australia can maintain a “narrow path” of preserving economic growth even with these large increases in interest rates. Yet there are worrying signs that Australia’s economy is edging closer to a recession. Apart from weak retail spending, falling business and consumer sentiment as well as a sharp collapse in new housing construction suggests tougher times ahead.

Even with significant risks on the inflation, interest rate and political fronts – global shares delivered strong gains. Global share prices fell sharply at the start of the financial year as the impact of rising bond yields and interest rates made investors very cautious. Global shares rebounded strongly from October 2022 with the comfort that corporate profits have been resilient to the risks and the belief that ‘Artificial Intelligence’ (AI) will deliver remarkable benefits. Essentially this was a ‘year of magical thinking’ by share investors and day traders. Global shares delivered a very strong return of 20.4% for unhedged portfolios given the benefit of a weaker Australian dollar over the past year while hedged portfolios returned 14.6%. Notably there has been a wide spectrum of share performances across countries and industries over the past year.

US shares as measured by the S&P 500 delivered a robust gain of 19%, in local currency terms, in the last financial year. This positive performance reflects the extraordinary gains of select ‘magnificent 7’ technology stocks. Investors poured their capital and optimism into stocks such as Apple (42% annual price gain), Alphabet/Google (10%), Amazon (23%), Facebook/Meta (78%), Microsoft (33%), Tesla (17%) and the chipmaker Nvidia (179%). ‘Artificial Intelligence’ has become the ‘Chat GPT’ mantra for investors. However, there is a question whether this optimism is ‘actual intelligence’ considering the risks that the US economy is already confronting. America’s regional banks are under strain with tightening credit conditions while high inflation is still a worry.

European shares also made strong gains even with the challenges of rising interest rates and Russia’s invasion of Ukraine on their doorstep. Investors perceive that the European share market could represent reasonable value compared to the high prices for technology shares on Wall Street.

The Japanese share market was the land of the rising sun with an extraordinary 25.7% (MSCI Japan Index, in local currency terms) annual gain given the benefit of interest rates remaining near 0% and a weak currency.

In sharp contrast, the Chinese share market continued to struggle with concerns over the government’s handling of the economy and private sector. China’s MSCI Index recorded a sharp negative return of -15.7%, in local currency terms, for the year. Other emerging markets were more encouraging. India (18.6% annual return, in local currency terms) and Taiwan (17.8%, in local currency terms) delivered strong gains, which allowed the broader emerging markets (unhedged) to stay positive at 5.1% for the year.

Australian shares as measured by the S&P/ASX 200 made a strong 14.8% return for the year. The sharpest annual gains were in the Information Technology sector (38.1%) which accords with the global mania for technology. The Resources sector also made very strong gains of 23% given the benefit of strong commodity prices and a lower Australian dollar boosting profits. Even the Consumer Discretionary (13.3%) and Financial (13.1%) sectors delivered surprisingly strong gains despite the challenge of higher inflation and interest rates squeezing consumers.

Australian fixed income managed to scrape in a mildly positive 1.2% annual return but this was notably below the 2.9% cash return. Global bond investors had a disappointing year with a weak -1.2% return given rising inflation and interest rates.

Global property securities (hedged) also suffered with a -5.9% return. The sharp rise in interest rates as well as worries about ‘working from home’ negatively impacting office occupancy has seen property securities underperform.

Prospects for the coming financial year

The troubling trio of inflation and interest rate pressures as well as the war in Ukraine remains challenging. Consumers are being squeezed by the higher ‘cost of living’. Central banks have only added to the pain by rapidly raising interest rates to cool these inflation pressures.

Investors are very worried about whether central banks can skilfully navigate the “narrow path” of preserving economic growth and lowering inflation. As interest rates rise and financial conditions for borrowers become tougher, investors are concerned that a global recession could occur in the coming year.

However, there are some hopeful signs that share investors are currently focusing on. Global inflation pressures show signs of moderating. Lower oil prices and shipping costs suggest that global inflation should gradually fall. Yet price pressures are still very evident with rising electricity and food costs as well as residential rents. Thus, the inflation threat is likely to keep flashing on the radar screen for the coming year.

Assessing these considerable inflation and interest rate risks for the new year is very challenging. Given the current investment climate is complex with multiple positive and negative scenarios possible, investors should maintain a disciplined and diversified strategy to manage these extraordinary risks.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLC), part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

No member of the Insignia Financial Group guarantees or otherwise accepts any liability in respect of any financial product referred to in this communication. The capital value, payment of income, and performance of the Funds are not guaranteed. An investment in the Funds is subject to investment risk, including possible delays in repayment of capital and loss of income and principal invested.

This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The returns specified in this communication are reported before management fees and taxes. Share market returns are all in local currency.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis. MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.