Comfortable retirement lifestyle for retirees

Most of us daydream about the day we finally finish work and retire. Whether you dream of cruising around the world, campervanning around Australia, or just pottering about in the garden and improving your golf skills, the magic question is: how much do you need to make your retirement dreams a reality?

According to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a ‘comfortable’ retirement, single people will need $545,000 in retirement savings, and couples will need $640,000. You can use this guide to estimate how much money you’ll need to have a ‘comfortable’ or ‘modest’ retirement. The Standard is updated four times a year to take into consideration the rising price of items like food and utility bills, as well as changing lifestyle expectations and spending habits. The Standard includes the cost of things such as health, communication, clothing, travel and household goods.

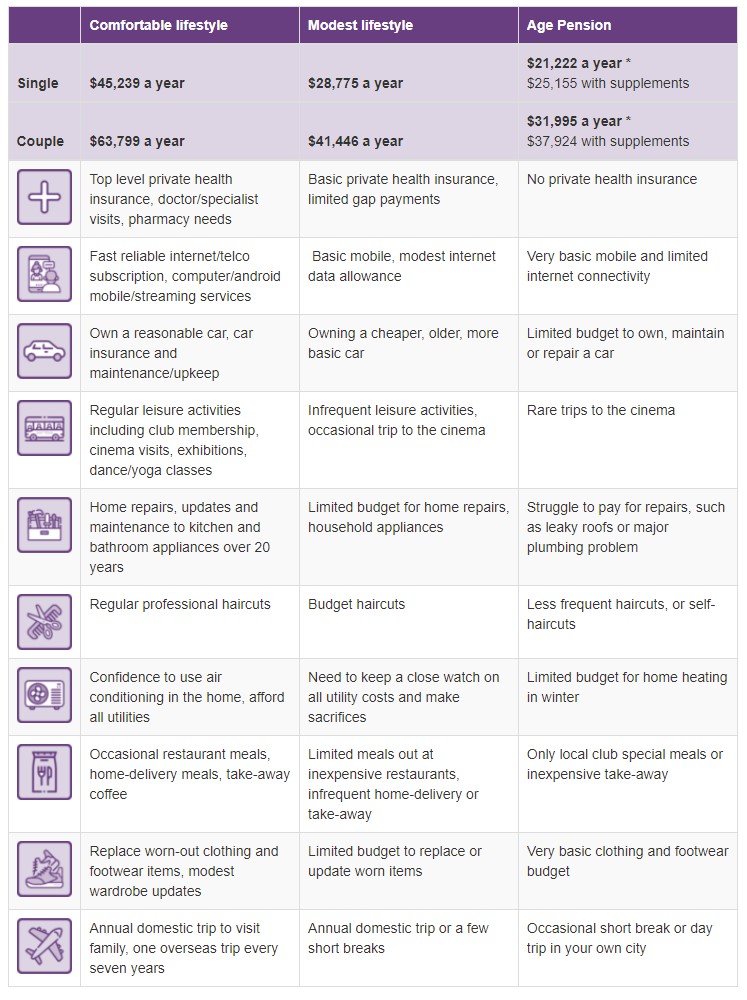

The comfortable retirement standard allows retirees to maintain a good standard of living in their post work years. It accounts for daily essentials, such as groceries, transport and home repairs, as well as private health insurance, a range of exercise and leisure activities and the occasional restaurant meal. Importantly it enables retirees to remain connected to family and friends virtually – through technology, and in person with an annual domestic trip and an international trip once every seven years.

The modest retirement standard budgets for a retirement lifestyle that is slightly above the Age Pension and allows retirees to afford basic health insurance and infrequent exercise, leisure and social activities with family and friends.

Both budgets assume that the retirees own their own home outright and are relatively healthy.

Living costs for Australian retirees rise at fastest pace in a decade.

The Association of Superannuation Funds of Australia (ASFA) says accelerating cost of living pressures are impacting on retirees with the highest annual increase in retiree budgets since 2010.

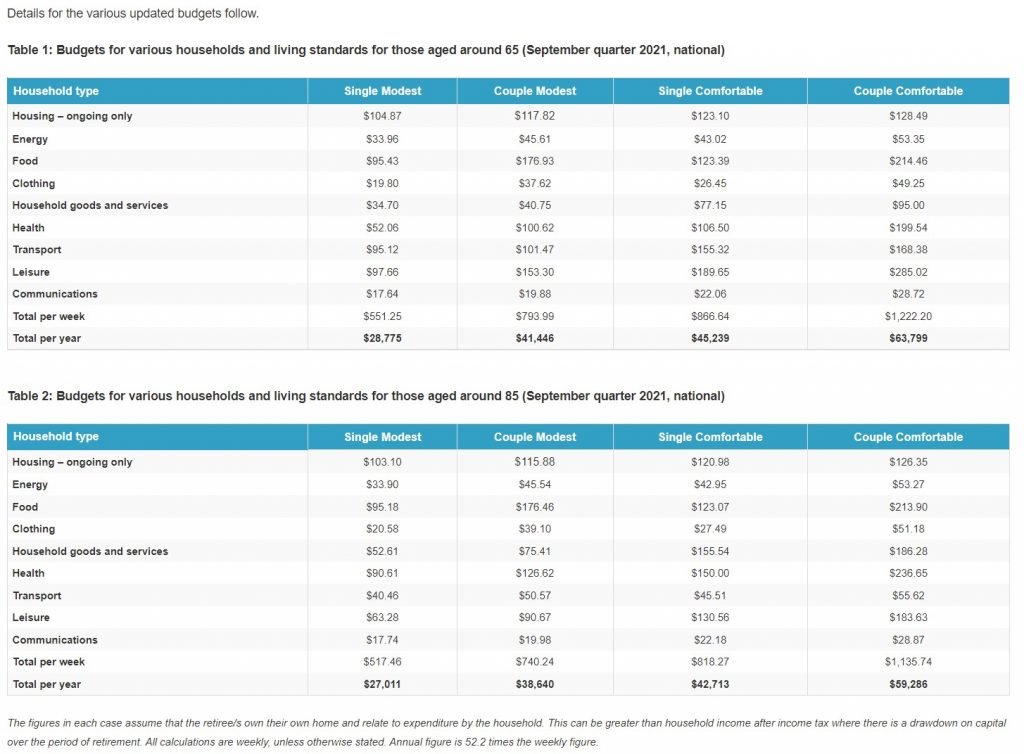

The ASFA Retirement Standard September quarter 2021 figures indicate that couples aged around 65 living a comfortable retirement need to spend $63,799 per year and singles $45,239, up by 0.9 per cent and 1.0 per cent respectively on the previous quarter.

The percentage increase in the budgets for those aged around 65 was higher than the increase in the September quarter All Groups CPI of 0.8 per cent.

“Australian retirees are now facing significant pressure on their budgets, given a range of unavoidable price hikes including petrol and council rates,” said ASFA Deputy CEO, Glen McCrea.

“It’s critical that future retirees are able to build sufficient retirement savings to ensure they can have dignity, health, vitality and connection in retirement. Moving Australia to the 12 per cent Superannuation Guarantee (SG) setting is an important step towards ensuring future generations can be confident to meet the financial challenges of retirement,” Mr McCrea concluded.

Over the year to September 2021 prices were up by around 2.8 per cent for the ASFA comfortable couple budget and by 3.0 per cent for the ASFA comfortable single budget.

Details for the retirement budget price changes

- Automotive fuel prices reached a record level in the September 2021 quarter, leaping 7.1% due to higher global oil prices amid economic recovery and supply disruptions.

- Over the past twelve months automotive fuel prices rose sharply (+24.6%) with a strong increase in the price of motor vehicles (+6.2%) as well.

- Property rates rose 3.3%, which is the largest rise since 2016. Many councils increased rates after implementing smaller rises, rebates or rate freezes last year.

- Restaurant meals (+1.6%) and Takeaway and fast foods (+1.3%) both rose primarily due to reduced uptake of the NSW ‘Dine & Discover’ and City of Melbourne ‘Melbourne Money’ voucher schemes compared to the June 2021 quarter. These vouchers reduced the out-of-pocket costs for consumers, hence fewer vouchers being redeemed resulted in a price rise in the September quarter.

- Furniture (+3.8%) prices rose due to supply shortages and elevated demand from households.

- Motor vehicles rose 1.4% due to continued strength in demand combined with supply constraints such as the global semi-conductor shortage, COVID-related factory closures and shipping costs.

- Audio, visual and computing equipment prices rose 1.8% in the quarter. Prices increased for goods such as TVs and computers as supply disruptions, due in part to the global semi-conductor chip shortage, were combined with elevated demand from households.

- Over the past twelve months there was a strong increase in the costs of domestic holiday travel and accommodation (+3.8%).

Details for the various updated budgets follow.

Source: https://www.superannuation.asn.au/resources/retirement-standard