The advent of artificial intelligence (AI) has widened the divide with optimists imagining productivity gains, the creation of new industries, and better lives for all. Pessimists envisage societal dislocations, perhaps even apocalyptic consequences akin to Hollywood science fiction.

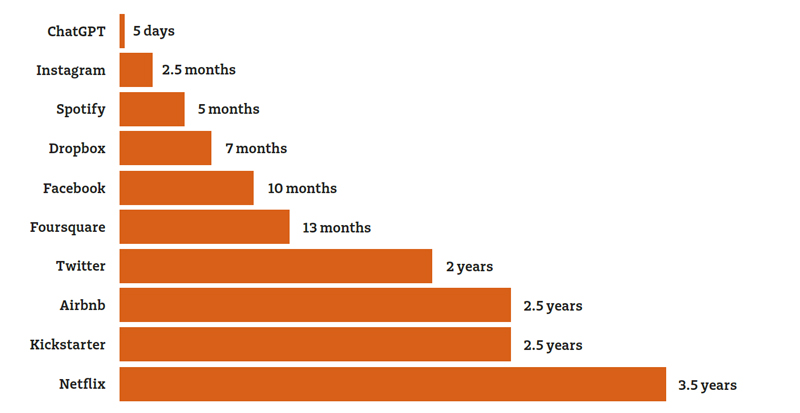

While AI in various forms has been around for more than 50 years, the 2022 release of OpenAI’s ChatGPT catalysed the next leg of interest and commercialisation captivating consumers to the point where the application reached one million users in under a week, the fastest adoption of an online application to date (Chart 1).

Chart 1: ChatGPT reached one million users faster than any other online application

Amount of time to reach one million users for online applications

Source: Statista, with data from company announcements via Business Insider/LinkedIn, as of 24 January, 2023. Kickstarter measured as one million backers, Airbnb measured as one million nights booked. Instagram measured as one million downloads.

It’s early days for the newest manifestations of AI and our thoughts are likewise preliminary.

Defining artificial intelligence

After that entrée, it may be useful to define the term “artificial intelligence” as it assumes a shared understanding of its meaning.

“In short, AI is the ability of a machine to perform cognitive functions typically associated with human minds, such as perceiving, reasoning, learning, interacting with the environment, and problem solving. Examples of AI technologies include robotics, autonomous vehicles, computer vision, language, virtual agents, and machine learning.” 1

Now’s also a good time to be reminded of a quote by Roy Amara, an American futurologist:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

There is abundant literature arguing that a very large part of the economy is likely to see AI integration and widespread employment dislocations, but it’s equally reasonable to assert that a good deal of what’s been voiced falls into the ‘guesstimate’ category.

AI has been held up as a game-changer akin to the Industrial Revolution, which represented a break from thousands of years of human history as life on the land gave way to urban living, and so much more.

A sober perspective would be to expect the most significant changes, and productivity gains showing up in a decade or two from now, because that’s been the trend with past innovations that benefit society. Unlocking the potential productivity benefits of the technology will require the reskilling of workforces and organisational and process innovation, both of which are historically slow-moving.

AI adoption, for now, appears to be greatest in a few pockets of the economy, like customer contact centres and software engineering, where it is particularly compelling as a productivity enhancer that can reduce labour costs.

Even so, we need to guard against over-egging potential productivity benefits because productivity growth data around computers and the internet shows that while productivity has been boosted, it has not been a massive boost and productivity growth reverted to around the 1970s–’80s pace after the late 1990s and early 2000s.

Knowledge workers to be most impacted

It’s easy to be overwhelmed by statistics and forecasts around the impact of AI so I’ll mention just a few.

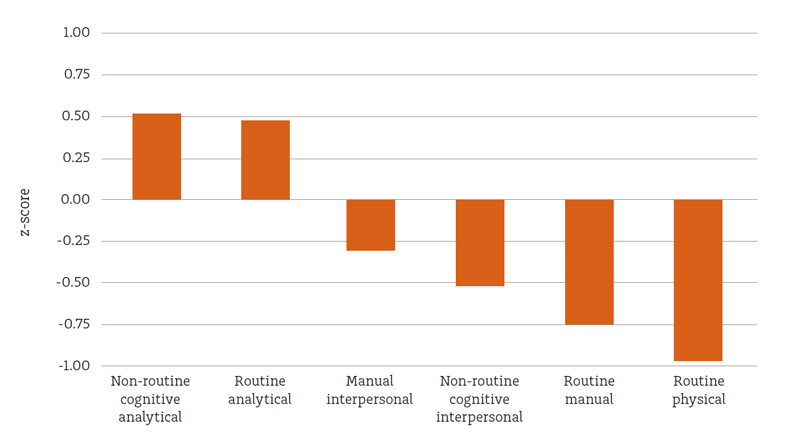

One study suggests that in the United States, 60% of occupations and 80% of workers will be impacted by AI by 2040.2 Moreover, rather than blue collar and physical work being most affected, it’s those engaged in knowledge work that are more vulnerable (Charts 2 and 3).

Chart 2: Knowledge workers are most at risk from AI

Occupation skills and generative AI exposure

Note: AI exposures converted into standard z-score. A z-score measures exactly how many standard deviations above or below the mean (average) a data point is.

Source: Generative AI and firm values by Andrea L. Eisfeldt, Gregor Schubert, Miao Ben Zhang, Working Paper 31222 http://www.nber.org/papers/w31222 NATIONAL BUREAU OF ECONOMIC RESEARCH taken from AI: Winner takes most, Australia February 2024, TD Global Investment Solutions, TD Epoch

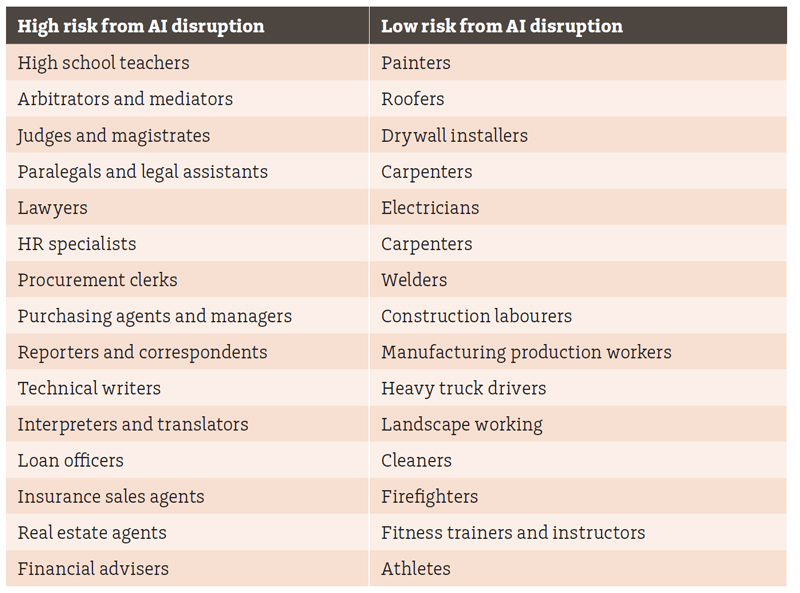

Chart 3: Some surprises around high risk of disruption and low risk of disruption jobs from AI

Source: How will language modelers like ChatGPT affect occupations and industries? Ed Felten (Princeton)

Manav Raj (University of Pennsylvania) Robert Seamans (New York University)1 March 2023 taken from AI: Winner takes most, Australia February 2024, TD Global Investment Solutions, TD Epoch

Perhaps one reason for this is that the productivity of physical work has risen impressively over multiple decades with coal miners’ productivity, for example, having climbed around 830% since 1949. 3

It’s difficult to imagine white collar work being able to claim such productivity gains despite the adoption of technologies ranging from the personal computer in the 1980s to contemporary digital technologies.

However, rather than focusing so much on impacts on current jobs and industries, it’s likely that the bulk of the gains will come from new products and industries.

Think of how email, in the mid-1990s, replaced the fax machine, or the personal computer, in the 1980s, replaced physically storing receipts.

A takeaway from all this is that the best jobs to have will likely to be those that complement AI, while prospects for jobs that can be replaced, which are mainly cognitive based ones, are dimmer.

Ironically, being less educated might be the right move for finding or keeping a job in the future.

AI winners: incumbents to get stronger?

At this time, there are few pure play, publicly traded companies in the AI realm, and incumbents with their first mover advantages, existing networks of users and distribution, as well as proprietary data to train large language models, having fared well.

Recent market reactions have validated this view, as large cap technology stocks have outperformed smaller counterparts, suggesting many investors believe the incumbents are poised to capitalise on the first wave of AI adoption.

Capitalism is meant to unfold in a process of creative destruction in which up and comers challenge and eventually knock-off stuck-in-the-mud incumbents. However, incumbents in the technology industry have remained competitive and compounded on their advantages. Incumbents from a decade ago such Alphabet/Google, Meta/Facebook, and Microsoft have continued to dominate the technology landscape and remain leaders today.

A reason for this is the “network effect”, which describes a situation in which the value of a product, service, or platform depends on the number of buyers, sellers, or users who leverage it. Generally, the greater the number of buyers, sellers, or users, the greater the network effect—and the greater the value created by the offering.

Think about how this network effect has benefited Apple. Any person with an Apple device can communicate easily with any other person who also owns an Apple device. As more people own compatible technology, the value of also owning an iPhone, iPad, or MacBook increases.

In other words, Apple makes it beneficial to buy into the Apple ecosystem by making each different device (phone, tablet, laptop) compatible with one another. Ditto for other technology giants.

A study revealed that network effects were responsible for around 70% of the total value created in tech in 2022.2 So, rather than being threatened and displaced by AI, from today’s vantage point, at least, it may benefit already strong industry incumbents.

This isn’t theoretical.

Microsoft, for instance, has a partnership with OpenAI and has captured mind share to become the first port of call for a company enquiring about AI. Anyone working with OpenAI will now work with Microsoft Azure, Microsoft’s public cloud computing platform, benefitting Microsoft.

Microsoft also has in-built advantages owing to the fact that most businesses have pre-existing relationships with the company and its products.

Other tech giants like Amazon, Alphabet/Google, and Meta/Facebook are investing significantly in AI research and development to make the technology accessible for enterprise use cases, so maybe, in the first stage of AI for business, at least, incumbents will dominate.

At its core, AI is about data size coupled with quality and the tools that extract information in ways that boost productivity. Large companies with valuable data sets will have an advantage when training models on which to build new applications.

Moreover, companies that enable the massive amounts of computing power required to train and operate these models, particularly in the semiconductor space, have emerged as early beneficiaries.

For example, demand for Nvidia’s industry-leading graphics processing units (GPUs) has exploded as companies compete to buy these chips in order to run AI models, even going as far as leveraging a company’s supply of Nvidia GPUs as a recruiting tactic for AI researchers.

The emergence of AI presages the next wave of technology industry investment. This capital expenditure will be welcomed by current as well as prospective customers as it will result in better and more useful products.

Shareholders, however, may have mixed feelings as the spending will likely crimp margins, and the potential for a digestion period after rapid early adoption remains a possibility. Moreover, coinciding at a time when the cost of capital has been rising, investors will need to be very discriminating over which companies and technologies they back with their capital.

An abundance of scepticism over ‘shiny objects’ will be required or else billions of dollars of capital will be burned, as was the case in the late 1990s technology boom that transitioned to a bust.

While all investment management companies leverage technology to a greater or lesser extent, quant-driven managers are likely to go further and quicker down the AI path than fundamental managers. To be clear, no investment manager is a Luddite.

It’s difficult to envisage any investment manager not leaning on computer power for everything from sophisticated modelling to discern likely asset class returns and earnings forecasts to fulfilling business processing tasks.

Investment industry adoption

The investment industry has been a fulsome technology adopter. For instance, some well-known investment firms adopted “natural language processing (NLP) techniques across a wide range of text sources including broker analyst reports, corporate earnings calls, regulatory filings, and online news articles.” 4

“When analysed at scale, each individual insight can be combined into an aggregate view that helps inform return forecasts.”

While all investment management companies leverage technology to a greater or lesser extent, quant-driven managers are likely to go further and quicker down the AI path than fundamental managers. To be clear, no investment manager is a Luddite.

It’s difficult to envisage any investment manager not leaning on computer power for everything from sophisticated modelling to discern likely asset class returns and earnings forecasts to fulfilling business processing tasks.

More administrative and process-related functions will likely be automated, and AI-based algorithms and machine learning will enable better risk measurement and tracking.

We can also envisage evolutions of AI being used to identify nonintuitive relationships between market indicators and securities, as well as analysing oceans of alternative data, such as credit card data, store circulation data, satellite images, weather forecast, container shipping movements, monitoring search engines for keywords, and so much more, to help frame strategies.

Benefits of our manager-of-managers approach

As a manager-of-managers, we have access to investment firms with complementary styles, philosophies, and approaches. It means that the portfolios we manage for our clients are not dependent on any single way of doing things for success.

This helps to both mitigate risk, as well as to accumulate returns from multiple ways of doing things. The beauty of investment management is that no single way of investing succeeds all the time and so combining them skilfully, as we do in multi-asset portfolios, increases the odds of delivering strong long-term returns.

The valuations of companies directly associated with AI have increased significantly. Some managers believe those companies’ valuations will continue to increase, while other managers are finding opportunities in companies that can be described as ‘AI-adjacent’, that is, those providing products and services to AI-related companies.

This enables our portfolios to participate in the AI theme more broadly.

From our perspective, it’s not just the obvious “picks and shovels” providers that are reaping the benefits of AI commercialisation. Many “old economy” companies are increasing their productivity by adopting AI in both the development and delivery of their products.

Some examples of domestic companies bringing the benefits of AI into our investment portfolios include Sonic Healthcare, Treasury Wine Estates, and Suncorp. These companies use AI in a variety of ways that benefit customers and shareholders too. Our investment managers are consistently on the lookout across the value chain to identify companies who are improving their businesses in a variety of ways, including by adopting AI.

Finally, our private market investments are also participating in the AI theme as diverse companies, not listed on share markets, examine ways of incorporating the technology to drive business efficiency.

1 The future is now: Unlocking the promise of AI in industrials. Article jointly authored by Kimberly Borden, Mark Huntington, Mithun Kamat, Alex Singla, Joris Wijpkema, and Bill Wiseman, from McKinsey & Company, December 6, 2022, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-future-is-now-unlocking-the-promise-of-ai-in-industrials

2 AI: Winner takes most, Australia February 2024, Kevin Hebner, Investment Strategist, TD Global Investment Solutions, TD Epoch

2 Network Effects: The Hidden Force Behind 70% Of Value In Tech, James Currier, 11 October 2022, https://www.forbes.com/sites/forbesbusinesscouncil/2022/10/11/network-effects-the-hidden-force-behind-70-of-value-in-tech/?sh=25d636a430ed

3 Ibid

4 AI is transforming investing, 15 June 2023, https://www.blackrock.com/us/individual/insights/ai-investing

Dan Farmer, Chief Investment Officer

.Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLCI) and IOOF Investment Service Limited (ABN 80 007 350 405, AFSL 230703) (IISL). Both MLC and IISL are part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLCI or IISL does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs. Past performance is not a reliable indicator of future performance. Share market returns are all in local currency. Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice), or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLCI or IISL may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis. MLCI and IISL rely on third parties to provide certain information and is not responsible for its accuracy, nor is MLCI nor IISL liable for any loss arising from a person relying on information provided by third parties. Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI or IISL, and neither MSCI or IISL bear liability with respect to any such funds.