Reforms in aged care in recent years has meant the system has become complex and could even be confusing. Throw in that it is a highly emotive topic and it means it is an area that is in-demand for quality financial advice.

With a Royal Commission into aged care announced in 2018 we expect to see more changes and more demand for services, advice and options, so here are some things to consider if you are looking at care for yourself or a loved one either at home or at a local aged care facility.

Did you know? There are about 1.3 million people in Australia who access aged care (Aged Care Roadmap, Australian Government, March 2016).

Aged care is not just for the elderly. Usually it is the children or grandchildren that are forced to look into aged care when the need becomes desperate, and by that time it is often too late to properly consider and plan for the best outcome. The earlier you think about aged care, the more in control you are, and the better outcome you can hope for.

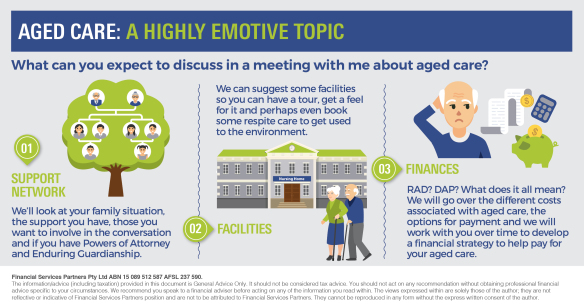

As a professional financial adviser specialising in aged care I take pride in working with my clients over time to consider their whole financial plan, a part of which is aged care. By working together we build a better relationship, one based on trust and understanding, and this helps my clients get peace of mind that they have someone looking out for their financial future and lifestyle.

Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Financial Services Partners position and are not to be attributed to Financial Services Partners. They cannot be reproduced in any form without

the express written consent of the author.

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. Financial Services Partners Pty Ltd ABN 15 089 512 587, AFSL 237590