You can look at the ‘Retirement Standard’ guide by the Association of Superannuation Funds of Australia (ASFA) for a guideline on how much you might need, but if you want to get a more accurate figure, a financial adviser can help you work it out.

- A couple of about 65 years of age – $40,194pa is needed to live modestly.

- A couple of about 65 years of age – $61,786pa is needed to live comfortably.

- For singles of about 65 years of age – $27,913pa is needed to live modestly.

- For singles of about 65 years of age – $43,787pa I needed to live comfortably.[1]

The ASFA considers that for those with good health who own their own home, a comfortable lifestyle includes owning decent household goods, private health insurance, nice clothes, a decent car, a meal out a couple of times a week, and semi-regular travel. This all sounds quite reasonable, but there are a lot more expenses to consider in retirement such as regular paid activities and social outings, increased medical expenses and unpaid work you may do such as looking after grandchildren and the expenses associated with them.

What about the age pension?

For those eligible for the age pension, the full age pension for singles is $24,268pa which is nearly enough to live a modest lifestyle. For couples it is $36,582pa which is a bit short of a modest lifestyle so you would need other income to top this up.2

What’s this as a lump sum?

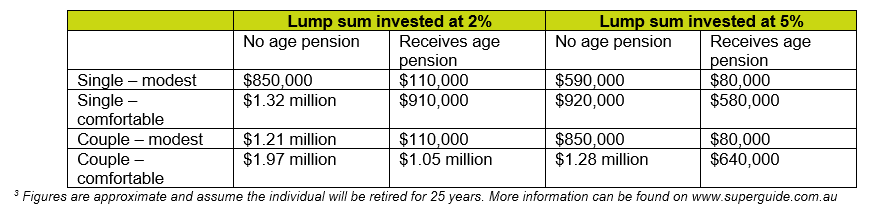

An independent superannuation resource has calculated a lump sum you might need to have set aside the day you retire in order to live a basic or comfortable lifestyle in retirement. The website demonstrates the different amounts needed based on the investment rate of these lump sums and whether or not you are receiving the age pension.

What does it all mean?

If you are in a couple and you want to retire at around 65 years old, you expect to live the average life expectancy, and you want a comfortable lifestyle, you will need to have a lump sum of about $1.97 million dollars, invested in an investment vehicle returning about 2% per annum. If you have it invested in a vehicle returning 5% your lump sum can drop to $1.28m.

All of this can take a bit of time and energy to work out, but it is nice to have a magic number to work towards and to know that when your money is invested and you are working with a professional financial adviser who understands how it all works, you should have enough to last through your retirement.

With this information and a renewed energy to get your super on track, call your financial adviser and make an appointment to discuss making sure you have enough in retirement.

1 https://www.superannuation.asn.au/resources/retirement-standard as at September 2019

2 https://www.humanservices.gov.au/individuals/services/centrelink/age-pension/how-much-you-can-get

3 http://www.superguide.com.au/boost-your-superannuation/comfortable-retirement-how-much-super-need http://www.superguide.com.au/boost-your-superannuation/comfortable-retirement-how-much-super-need

The information, including tax, provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. The views expressed in this publication are solely those of the author; they are not reflective or indicative of Licensee’s position, and are not to be attributed to the Licensee. They cannot be reproduced in any form without the express written consent of the author.