Impact of reacting to short-term noise

Volatility is part of investing, and whilst we can avoid it, there’s typically a price to pay for doing so in the form of lower expected returns over the long term.

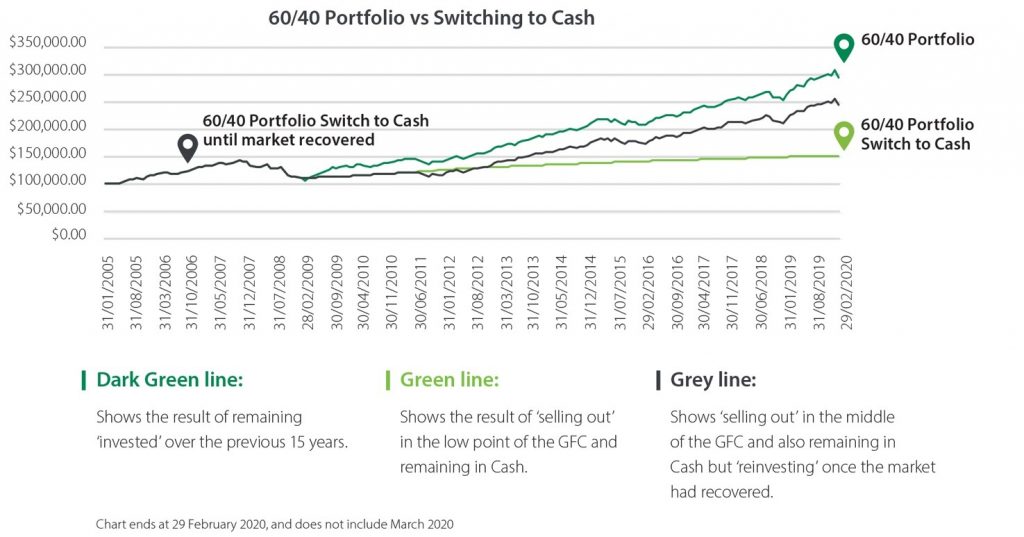

The chart below shows the impact different strategies have had on an investment portfolio over the previous 15 years.

As you can see, this example shows the volatility (Dark Green line) – larger moves both up and down – but highlights that by remaining ‘invested’ over the long term has resulted in a significantly higher portfolio balance at the end of the period.

The GFC was an uncomfortable investing experience, much like today’s environment. However, a well-diversified portfolio protected investors during the drawdown (this example portfolio fell by ~26% at its lowest, whilst Australian shares fell as much as 47%) and remaining in the market helped investors enjoy significant gains over the past decade.

Please note: Past performance is not necessarily indicative of future returns.

The information, including tax, provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. The views expressed in this publication are solely those of the author; they are not reflective or indicative of Licensee’s position, and are not to be attributed to the Licensee. They cannot be reproduced in any form without the express written consent of the author.