Key events in February

- Global share prices made solid gains in February given continued optimism on the prospects for Artificial Intelligence ‘AI’. The largest AI chipmaker in Nvidia led the charge with a 29% price gain in February given strong profit growth. This technology optimism overcame concerns over slower global economic activity.

- European share markets advanced solidly with hopes for falling interest rates in 2024. However, these interest rate hopes are driven by Europe’s weak economic activity with both German and British gross domestic product (GDP) data confirming mild recession occurred last year.

- Chinese share markets surprised with strong gains given that China’s 5 year prime rate was cut by 0.25% to 3.95% in February. This should provide some support to China’s weak housing market.

- Australian shares delivered a mild gain and are near record highs. The Information Technology sector surged with a 19.7% gain given the technology optimism. Consumer Discretionary (9.7%), Real Estate Investment Trusts (4.8%) and Financial (3.5%) sector shares also made strong gains given hopes for lower interest rates this year. However, there were some disappointments with a sharp -6.0% negative return for the Resources sector given lower iron ore, lithium and nickel prices.

- Australia’s economy appears subdued but is also experiencing a welcome decline in inflation. Employment and retail spending have fallen in the December-January period. In more positive news, consumer annual inflation came in at 3.4% in January. This was the lowest inflation in the past two years and suggests that the Reserve Bank of Australia (RBA) could consider lowering interest rates this year.

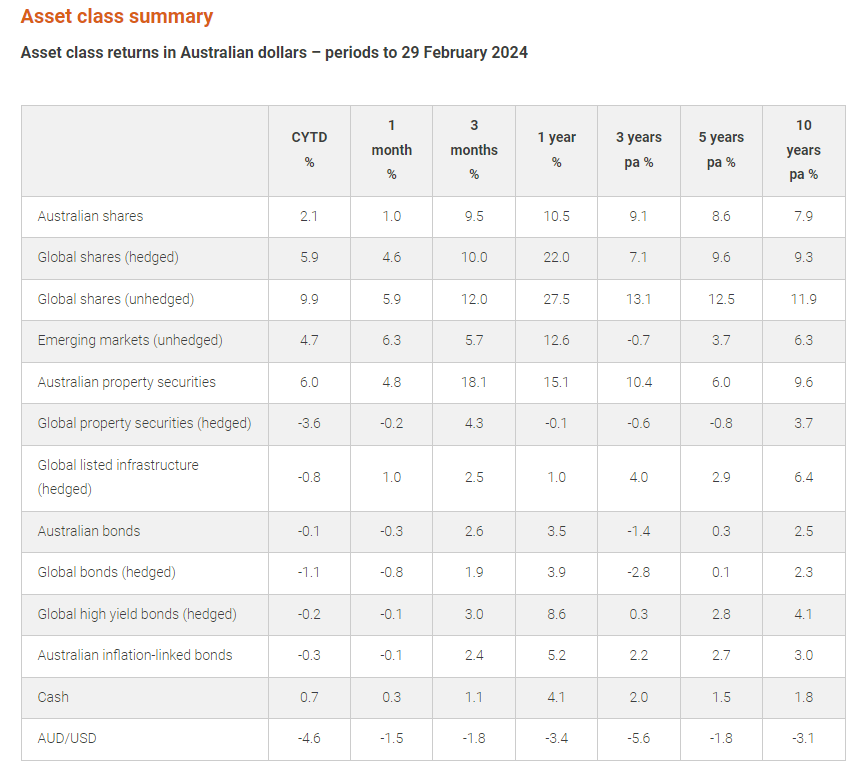

Past performance is not a reliable indicator of future performance.

Sources: Australian shares – S&P/ASX 300 Total Return Index; Global shares (hedged) – MSCI All Countries World (A$ hedged, Net); Global shares (unhedged) – MSCI All Countries World in A$ (Net); Emerging markets – MSCI Emerging Markets in A$ (Net); Australian property securities – S&P/ASX 300 A-REIT Accumulation Index; Global property securities – FTSE EPRA/NAREIT Developed (A$ hedged, Net); Global listed infrastructure – FTSE Global Core Infrastructure 50/50 (Hedged $A); Australian bonds – Bloomberg AusBond Composite 0+ Yr Index; Global bonds (A$ hedged) – Barclays Global Aggregate (A$ hedged, Gross); Global high yield bonds (A$ hedged) – Barclays US High Yield Ba/B Cash Pay x Financials ($A Hedged); Australian inflation-linked bonds – Bloomberg AusBond Inflation Government 0+ Yr Index; Cash – Bloomberg AusBond Bank Bill Index; AUD/USD – WM/Reuters Daily (4 pm GMT).

Key events in global markets over the last three months to February

Global shares have achieved very strong gains over recent months despite a ‘wall of worries’. Optimism on AI, milder global inflation and hopes that central banks would consider reducing interest rates have driven share prices. Global shares (unhedged) recorded an exceptionally strong 12% return for the past three months. The fall in the Australian dollar has also boosted global shares (unhedged) returns. Hedged global shares delivered a more moderate but still very strong 10% return for the last 3 months.

Wall Street’s benchmark S&P 500 Index delivered an extraordinary 11.9% return in local currency terms for the quarter. US consumer inflation has moderated over the past year which has allowed the US central bank to suggest that lower interest rates are on the agenda for 2024.

European shares have also delivered strong gains in local currency terms. While the continuing Russia-Ukraine war is a major concern, investors have taken solace in milder inflation and the prospect for lower interest rates.

Asian share markets have delivered a mixed performance. Chinese share markets have been very weak with a -5.1% return in local currency terms for the MSCI China Index. Concerns over China’s economic activity and the financial stress in the property sector remain headwinds to investors. By contrast, Japan’s Nikkei 225 Index delivered an exceptionally strong 17.2% quarterly return with the central bank’s assurance that interest rates would remain low despite rising inflation.

Global bonds (hedged) delivered an encouraging revival with a 1.9% quarterly return. Milder inflation with signs of a slowing global economy has encouraged investors that lower interest rates are on the horizon.

Global high yield bonds (hedged) made a strong 3% gain for the quarter as investors found the elevated yield level of corporate bonds very attractive.

Key events in Australia over the last three months to February

Australian shares delivered an exceptionally strong quarterly return of 9.5%. There were remarkable gains for the Information Technology (28.3%) sector on ‘AI’ optimism. The Real Estate Investment Trust sector made a strong rebound of 18.1% on hopes that interest rates are set to fall this year. Strong gains for the Financial sector of 15.4% were also recorded with expectations that interest rates have peaked. Yet there were some disappointments. The Resources sector delivered a weak -2.3% return with concerns over the Chinese economy’s growth prospects.

Australia’s economy is displaying significant slowdown signs with weak retail spending and housing construction. The impact of higher goods and services prices, rising mortgage interest rates and rent have generated a ‘painful squeeze’ for Australian consumers. Australia’s central bank raised the cash interest rate by 0.25% to 4.35% in November 2023 citing that inflation was “still too high and is proving more persistent than expected.” However, there was some very welcome news with the release of the January 2024 data showing annual inflation has fallen to 3.4% – which is the lowest in the past two years. This generated optimism that Australian interest rates have peaked, and lower interest rates are on the central bank’s agenda for 2024.

Global prospects

Global share prices have favourably surprised investors recently by making extraordinarily gains. The mania for AI and technology has been a key contributor. There is also confidence that the inflation threat has faded which could lead interest rates to fall in 2024. However, these exuberant expectations may not be delivered if inflation proves more persistent and central bankers more stubborn in lowering interest rates. The continued tragic Russian-Ukraine War and Hamas-Israel conflict are also key threats to global economic stability and investor sentiment.

Accordingly, there are significant inflation, interest rate and political risks that investors should be cautious of. Assessing these complex risks is particularly challenging. As there are multiple positive and negative outcomes possible this year, investors should maintain a disciplined and diversified strategy.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLCI) and IOOF Investment Service Limited (ABN 80 007 350 405, AFSL 230703) (IISL). Both MLC and IISL are part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLCI or IISL does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. Share market returns are all in local currency.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice), or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLCI or IISL may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis. MLCI and IISL rely on third parties to provide certain information and is not responsible for its accuracy, nor is MLCI nor IISL liable for any loss arising from a person relying on information provided by third parties.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI or IISL, and neither MSCI or IISL bear liability with respect to any such funds.