Key Summary Points:

- Stock and Bond Markets have fallen dramatically this week, continuing the trend since the start of 2022.

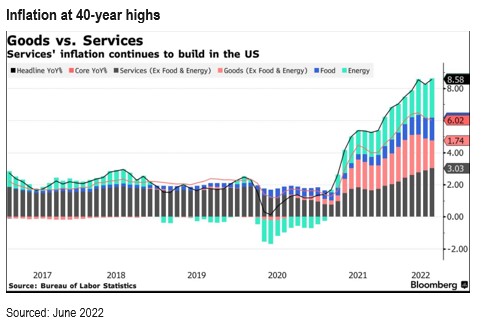

- High inflation in the U.S. was the cause – coming in at 8.6%. The highest in 40 years. This prompted the U.S. Federal Reserve to raise interest rates by 0.75%. Domestically, the RBA raised rates by 0.5%.

- The Inflation is being caused by a range of factors, including supply chain disruptions due to the COVID crisis and the war in Ukraine.

- Investors fear that rising interest rates, to combat inflation, will hurt economic growth and cause a recession.

- Fear of slower economic growth has hurt the share market, which performed strongly in 2020 and 2021.

- Stocks market and Bond market falls means they are now more attractively priced.

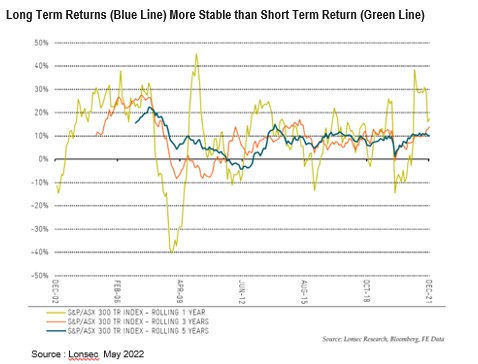

- It is important to take a long-term view and stay invested, with diversification, in line with your risk tolerance.

- Time in the market, is more important than timing the market.

The chart above shows the recent dramatic increases in U.S. Inflation with the colours reflecting where the inflation has come from – mainly from energy prices, services and food.

The COVID crisis and the war in Ukraine caused reduced supply of goods and services. Also, just after the COVID crisis back in March 2020, governments and central banks increased the money supply to support markets and economies. The increased money supply, meant more money bidding for the same quantity of goods, causing rising prices. This will likely continue throughout 2022, as it takes time to work through the global economy.

Outlook

We expect inflation and interest rates to continue rising in 2022. This will have an effect in the short-term, dampening economic growth. We also expect inflation to reduce in 2023 and this should take pressure off the global economy. This is because the supply side shocks should reduce as the world opens up after the COVID crisis.

An end to the war in Ukraine would also help the inflation situation, as the supply of many key commodities would increase.

Markets have fallen substantially and are therefore more attractively priced than recent all-time highs at the end of 2021. There are asset classes that should do well in the coming periods, including floating rate Bond markets and asset classes that benefit from inflation – e.g. Infrastructure and Commodities.

One of the important lessons in investing is that time in the market, is more important than timing the market. The following chart demonstrates that whilst short term movements in markets (in this case the ASX 200) can be extremely volatile (as we have witnessed in the past six months), investing for the longer term (the blue line) provides a much more stable outcome. As we continue working through this period of heightened volatility, keeping the longer-term in mind remains important.

Authors: – Alex Harris & Ross Stanley (Research Analyst), Andrew Ash (Senior Manager)

Approved By: – Matt Olsen, Head of Research and Retirement Income

Research Analyst Disclosures:

I, Alex Harris, Ross Stanley and Andrew Ash, hereby certify that all the views expressed in this report accurately reflect my personal views about the subject investment theme and/or company securities. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

I, Alex Harris, Ross Stanley and Andrew Ash, and/or entities in which I have a pecuniary interest, have an exposure to the following securities and/or managed products mentioned in this report: Nil

Important Information

This report is prepared by Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837 (Bridges). Bridges is an ASX Market Participant and part of the IOOF group of companies. This report is prepared by the IOOF Research team for:

Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837, Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323, Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL 244252, RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429, Shadforth Financial Group Ltd ABN 27 127 508 472 AFSL 318613, Godfrey Pembroke Group Pty Ltd ABN 38 078 629 973 AFSL 245451 (‘Advice Licensees’). The Advice Licensees are part of the IOOF group comprising IOOF Holdings ABN 49 100 103 722 and its related bodies corporate (IOOF group).

The Advice Licensees and/or their associated entities, directors and/or employees may have a material interest in, and may earn brokerage from, any securities or other financial products referred to in this document, or may provide services to the company referred to in this report. The document is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of the Advice Licensees. The Advice Licensees and associated persons (including persons from whom information in this report is sourced) may do business or seek to do business with companies covered in its research reports. As a result, investors should be aware that the firms or other such persons may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as a single factor in making an investment decision.

The document is current as at the date of issue but may be superseded by future publications. You can confirm the currency of this document by checking the intranet site (links below).

The information contained in this report is for the sole use of advisers and clients of AFSL entities authorised by the Advice Licensees. This report may be used on the express condition that you have obtained a copy of the Advice Licensees Financial Services Guide (FSG) from their respective website.

Disclaimer: The information in this report is general advice only and does not take into account the financial circumstances, needs and objectives of any particular investor. Before acting on the advice contained in this document, you should assess your own circumstances or seek advice from a financial adviser. Where applicable, you should obtain and consider a copy of the Product Disclosure Statement, prospectus or other disclosure material relevant to the financial product before making a decision to acquire a financial product. It is important to note that investments may go up and down and past performance is not an indicator of future performance.

The contents of this report should not be disclosed, in whole or in part, to any other party without the prior consent of the IOOF Research Team and Advice Licensees. To the extent permitted by the law, the IOOF Research team and Advice Licensees and their associated entities are not liable for any loss or damage arising from, or in relation to, the contents of this report.

For information regarding any potential conflicts of interest and analyst holdings; IOOF Research Team’s coverage criteria, methodology and spread of ratings; and summary information about the qualifications and experience of the IOOF Research Team please visit https://www.ioof.com.au/adviser/investment_funds/ioof_advice_research_process