JobKeeper Payment extended

The JobKeeper Payment will be extended to 28 March 2021 for eligible businesses and not-for-profits. However, from 28 September 2020 the JobKeeper Payment rate will reduce. Prior to this announcement, the JobKeeper Payment was to cease on 27 September 2020.

Businesses and not-for-profits eligible for extended JobKeeper Payment from 28 September 2020

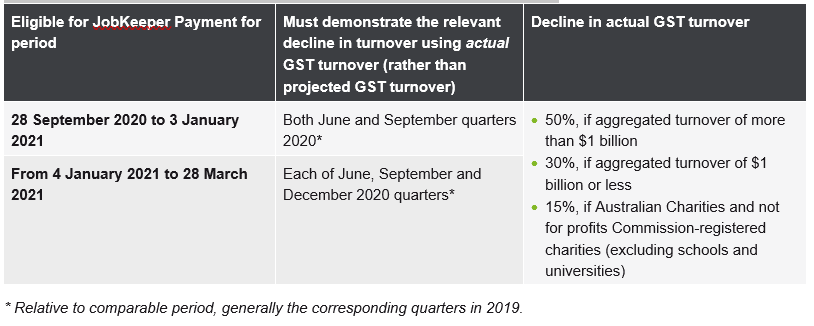

From 28 September 2020, businesses and not-for-profits will need to reassess their eligibility for the JobKeeper Payment by demonstrating they have suffered an ongoing significant decline in turnover using actual GST turnover (rather than projected GST turnover), as shown in the table below. Other eligibility rules for businesses and not-for-profits and their employees remain unchanged.

As the deadline to lodge a BAS for the September quarter or month is in late October, and the December quarter (or month) BAS deadline is in late January for monthly lodgers or late February for quarterly lodgers, businesses and not-for-profits will need to assess their eligibility for JobKeeper in advance of the BAS deadline in order to meet the wage condition. That is, the requirement to pay eligible employees in advance of receiving JobKeeper Payment in arrears from the ATO. The Tax Commissioner will have discretion to extend the time the entity has to pay employees in order to meet the wage condition, so that entities have time to first confirm their eligibility for the JobKeeper Payment.

JobKeeper Payment rate

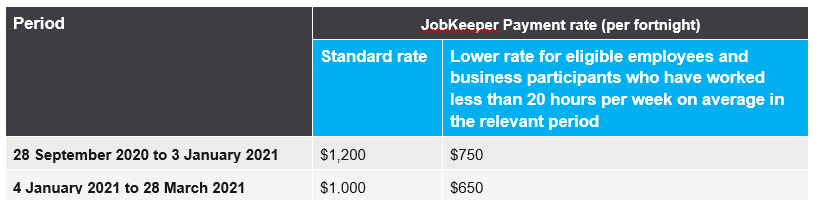

From 28 September 2020, the standard rate of JobKeeper Payment will reduce in two stages and lower payment rates apply to employees (and eligible business participants) of eligible businesses and not-for-profits who have worked less than 20 hours per week on average, in the four weekly pay periods before 1 March 2020 (or the month of February 2020 for eligible business participants).

JobSeeker Payment: Coronavirus Supplement, income test and waiting period changes

Extended and reduced Coronavirus Supplement

Payment of the Coronavirus Supplement has been extended to 31 December 2020. From 25 September 2020 to 31 December 2020, the supplement amount will be reduced to $250 per fortnight. This supplement is paid in addition to the actual JobSeeker Payment.

Existing JobSeeker Payment recipients and new JobSeeker Payment recipients will be eligible for the Coronavirus Supplement up until 31 December 2020. The Government has not indicated whether it can extend this supplement beyond this date.

Eligibility criteria for the Coronavirus Supplement remains the same.

Changes to the JobKeeper Payment may make recipients of that payment eligible for the JobSeeker Payment.

Adjustments to the JobSeeker Payment income test – 25 September to 31 December

Personal Income test

The income free area for JobSeeker Payment recipients will increase from $106 per fortnight to $300 per fortnight. This means recipients may receive income up to $300 per fortnight without any reduction in JobSeeker Payment.

Under the income test, every dollar received over $300 per fortnight will reduce JobSeeker Payment by 60 cents. Currently the JobSeeker Payment is reduced by 50 cents for every dollar received between $106 and $250 per fortnight and by 60 cents thereafter.

This income test is applied to the JobSeeker Payment only. If you are eligible for any JobSeeker Payment, you will get the full Coronavirus Supplement.

Partner Income Test

The reduction rate under the Partner Income Test will increase from 25 cents to 27 cents. Partners of JobSeeker Payment recipients may receive up to $3,086.11 per fortnight or $80,238.89 per annum before the JobSeeker Payment cuts out. Note, this assumes the JobSeeker Payment recipient has personal income below the income free area.

Asset Test and Liquid Asset Waiting Period to apply from 25 September 2020

The Asset Test will apply from 25 September 2020. For example, single homeowners with assessable assets of $268,000 or more will not be eligible for JobSeeker Payment. Partnered homeowners may have up to $401,500 in combined assessable assets.

The Liquid Asset Waiting Period (LAWP) of up to 13 weeks will be reinstated and the Income Maintenance Period (IMP) will continue.

The Ordinary Waiting Period, Newly Arrived Resident’s Waiting Period (NARWP) and the Seasonal Work Preclusion Period will continue to be waived until 31 December 2020.

Mutual Obligation Requirements

As previously announced Jobseekers’ mutual obligation requirements were gradually reintroduced from 9 June 2020.

Instant asset write-off thresholds for small businesses extended until 31 December 2020

Small businesses with aggregated annual turnover of less than $500 million may be eligible for an increased instant asset write-off on assets of up to the value of $150,000 from 12 March 2020 until 31 December 2020. The measure was set to finish on 30 June 2020, but the Government passed legislation to extend the measure until 31 December 2020.

The measure applies to new or second-hand assets first used, or installed ready for use, between 12 March 2020 until 31 December 2020 (inclusive). Certain assets are excluded, for example, horticultural plants and capital works deductions. There are limits to deductions for certain cars. The threshold applies on a per asset basis, so eligible businesses can immediately write-off multiple assets. You should confirm the entitlement to the tax deduction with your accountant.

Backing business investment

The Government has introduced a time limited 15-month acceleration of depreciation deductions for businesses with aggregated turnover below $500 million. Legislation to support this measure has already passed.

The deduction of 50% of the cost of an eligible assets on installation will be allowed, with existing depreciation rules applying to the balance of the asset’s cost. Eligible assets are new assets that can be depreciated under Division 40 of the Income Tax Assessment Act 1997 (ie, plant, equipment and specified intangible assets, such as patents) acquired from 12 March 2020 and first used or installed by 30 June 2021. Second-hand assets, or buildings and other capital works are not eligible assets. This concession will support business investment and economic growth over the short-term. You should confirm the entitlement to the tax deduction with your accountant.

| Please contact us if you have any questions or would like further information.

Disclaimer The information provided is general in nature. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this advice you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. This publication is prepared by IOOF for: Bridges Financial Services Pty Limited ABN 60 003 474 977 AFSL 240837, Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323, Elders Financial Planning ABN 48 007 997 186 AFSL 224645, Financial Services Partners Pty Ltd ABN 15 089 512 587 AFSL 237 590, Millennium3 Financial Services Pty Ltd ABN 61 094 529 987 AFSL 244252, RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429, Shadforth Financial Group Ltd ABN 27 127 508 472 AFSL 318613 (‘Advice Licensees’). This publication is not available for distribution outside Australia and may not be passed on to any third person without the prior written consent of the Advice Licensees. The views expressed in this publication are solely those of the author; they are not reflective or indicative of the Advice Licensees position and are not to be attributed to the Advice Licensees. They cannot be reproduced in any form without the express written consent of the author. |