Any little savings we make throughout the year can be diverted to a bigger savings pool such as an investment portfolio or term deposit to help build wealth over time.

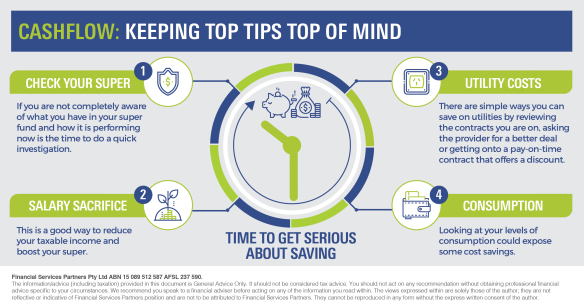

Check your super

If you are not completely aware of what you have in your super fund and how it is performing now is the time to do a quick investigation. Having one fund, instead of multiple funds may save you on fees. Being with a top performing fund rather than a default fund could mean a higher return on your investment, which really adds up over time. Making sure you are only paying for what you need is important, if you are paying for insurance when you have a separate insurance policy this could be an expense you get rid of. However, there is not a one size fits all approach, which is why tailored financial advice could help to find a super solution that suits your individual circumstances.

Salary sacrifice

This is a good way to reduce your taxable income and boost your super. Some of your pay is diverted to your super fund, hence reducing your taxable income, and this money is taxed within the super fund at only 15%. The other benefit of course is that it boosts your super fund and with the power of compound interest over time you can set yourself up for a nice retirement lifestyle.

Utility costs

Reviewing your utility costs each year can be a great way to make little savings add up. By reviewing the contracts you are on, asking the provider for a better deal or getting onto a pay-on-time contract that offers a discount are simple ways you can save on utilities. Consider ways you can be smarter with your utilities at home – buy energy efficient appliances, turn of lights when you are not using them, take shorter showers, install a water tank, be conscious of your use of utilities.

Consumption

Whilst you don’t want to deny yourself too many little luxuries or conveniences, looking at your levels of consumption could expose some cost savings. Consider walking or taking public transport rather than driving everywhere, only buy what you need at the grocery store rather than stockpiling, reduce the number of times you eat out or buy coffees by one less a week, don’t rotate your wardrobe items until you have worn out existing items, take advantage of free activities in your local area such as the library, beach, bushwalks which will connect you with the community and save money on entertainment.

A professional financial adviser can help you with cash flow and budgeting and then help you divert your savings into a vehicle that will start making you some money.

Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Financial Services Partners position and are not to be attributed to Financial Services Partners. They cannot be reproduced in any form without

the express written consent of the author.

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. Financial Services Partners Pty Ltd ABN 15 089 512 587, AFSL 237590